Crucial Steps to Make Use Of and obtain Bid Bonds Efficiently

Browsing the intricacies of quote bonds can significantly impact your success in protecting agreements. To approach this effectively, it's crucial to understand the essential actions included, from collecting essential documentation to choosing the best surety copyright. The trip starts with arranging your financial declarations and an extensive portfolio of previous tasks, which can demonstrate your dependability to possible guaranties. The actual obstacle exists in the careful choice of a respectable supplier and the critical utilization of the proposal bond to boost your competitive edge. What adheres to is a more detailed check out these important phases.

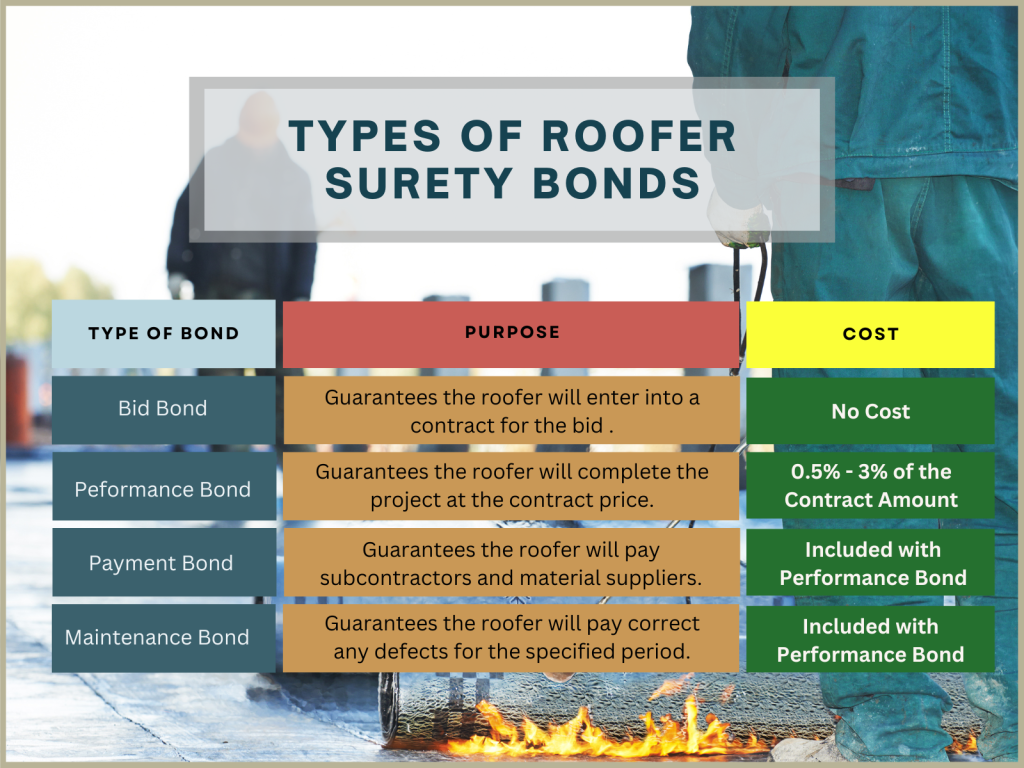

Understanding Bid Bonds

Bid bonds are a critical part in the construction and contracting industry, offering as a financial guarantee that a bidder plans to become part of the contract at the proposal price if granted. Bid Bonds. These bonds minimize the danger for project proprietors, ensuring that the chosen contractor will certainly not only honor the proposal however additionally secure efficiency and payment bonds as needed

Basically, a bid bond works as a protect, shielding the job proprietor versus the monetary ramifications of a professional taking out a bid or stopping working to commence the job after option. Generally issued by a guaranty firm, the bond guarantees payment to the proprietor, frequently 5-20% of the quote quantity, need to the contractor default.

In this context, quote bonds cultivate an extra competitive and credible bidding environment. They force service providers to present reasonable and severe proposals, recognizing that a financial penalty towers above any type of breach of dedication. These bonds ensure that only financially secure and qualified service providers participate, as the extensive certification process by surety firms displays out much less dependable bidders. As a result, quote bonds play a vital duty in preserving the integrity and smooth operation of the building and construction bidding procedure.

Planning For the Application

When preparing for the application of a bid bond, precise company and extensive documents are critical. A thorough review of the project specs and quote needs is essential to guarantee compliance with all terms.

Next, put together a listing of previous jobs, especially those comparable in range and size, highlighting effective completions and any type of qualifications or distinctions got. This plan gives an all natural sight of your company's approach to task execution.

Ensure that your organization licenses and enrollments are easily offered and updated. Having these records organized not just accelerates the application process but additionally forecasts a specialist picture, instilling confidence in possible surety providers and task owners - Bid Bonds. By methodically preparing these aspects, you place your business positively for successful proposal bond applications

Discovering a Guaranty Company

A surety business acquainted with your field will much better recognize the one-of-a-kind dangers and needs connected with your tasks. It is additionally a good idea to assess their economic ratings from agencies like A.M. Finest or Requirement & Poor's, ensuring they have the monetary stamina to back their bonds.

Involve with numerous companies to contrast prices, terms, and solutions. A competitive examination will certainly assist you protect the finest terms for your quote bond. Eventually, a detailed vetting procedure will certainly ensure a reliable partnership, fostering self-confidence in your proposals and future tasks.

Sending the Application

Sending the application for a quote bond is an important step that requires precise attention to information. This procedure starts by collecting all appropriate documentation, consisting of economic declarations, job specs, and a comprehensive business background. Making certain the precision and completeness of these documents is paramount, as any disparities can cause denials or hold-ups.

When submitting the application, it is a good idea to verify all entrances for precision. This consists of confirming numbers, making sure correct trademarks, and validating that all necessary attachments are included. Any type of noninclusions or mistakes can weaken your application, look what i found creating unneeded difficulties.

Leveraging Your Bid Bond

Leveraging your quote bond effectively can considerably enhance your one-upmanship in protecting agreements. A bid bond not just shows your financial security but likewise comforts the project proprietor of your dedication to fulfilling the contract terms. By showcasing your proposal bond, you can underscore your firm's dependability and reputation, making your bid index stick out amongst numerous competitors.

To take advantage of your proposal bond to its fullest capacity, guarantee it exists as part of a detailed proposal plan. Highlight the strength of your surety company, as this mirrors your firm's economic health and operational capacity. Additionally, highlighting your performance history of efficiently finished tasks can better instill confidence in the project owner.

Furthermore, preserving close interaction with your guaranty supplier can promote far better terms in future bonds, thus reinforcing your affordable placing. An aggressive approach to handling and restoring your proposal bonds can additionally stop lapses and make sure constant protection, which is important for continuous job purchase efforts.

Conclusion

Properly acquiring and utilizing quote bonds demands extensive prep work and tactical implementation. By comprehensively arranging key paperwork, picking a credible surety company, and sending a complete application, companies can safeguard the necessary quote bonds to boost their competitiveness.

Determining a reputable surety provider is a vital action in safeguarding a bid bond. A bid bond Check This Out not just shows your economic security but also guarantees the task proprietor of your dedication to fulfilling the contract terms. Bid Bonds. By showcasing your quote bond, you can underscore your company's integrity and reliability, making your bid stand out among various competitors

To take advantage of your quote bond to its greatest possibility, guarantee it is offered as component of a comprehensive proposal plan. By adequately arranging vital documents, picking a reliable surety company, and submitting a complete application, firms can secure the necessary bid bonds to enhance their competition.

Comments on “Typical Myths and Misconceptions Regarding Bid Bonds Debunked”